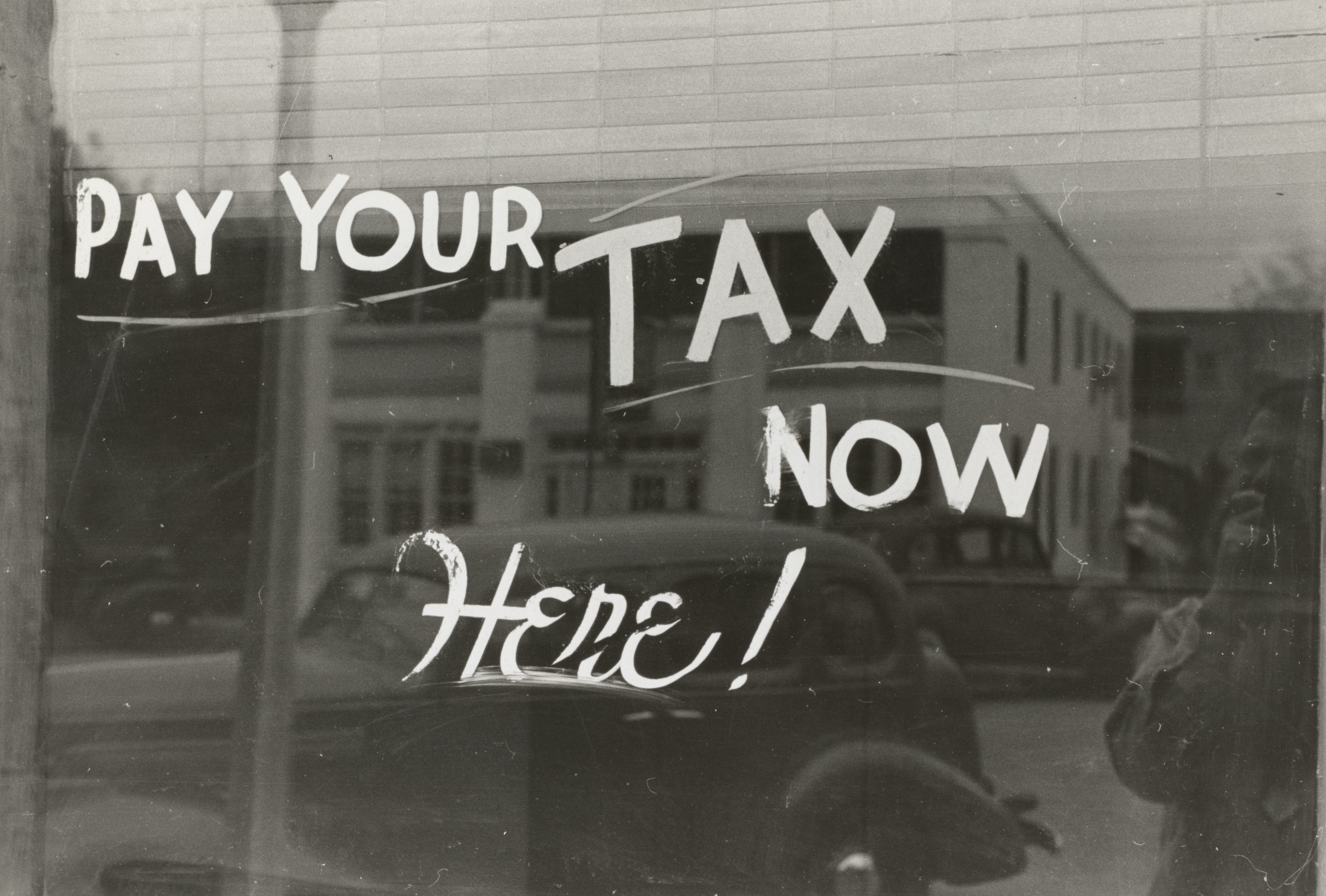

Don’t Put Off Filing Your Taxes

With the filing deadline moving from the traditional date of April 15th to July 15th because of the coronavirus pandemic, it can be tempting to take as much time as possible to file your taxes.

Most taxpayers look on the tedious task of compiling their financial records, tax documents and filing their taxes with trepidation. Procrastinating is not the answer. Unfortunately, the longer you wait to do your taxes, the greater the chances that something will go wrong.

And if you owe money to the IRS, the more penalties and interest you’ll accru. Often, it’s a better idea to file your taxes sooner rather than later.

Here’s why:

TAX IDENTITY THEFT

Tax return fraud is one of the most common and rapidly growing forms of identity theft. Basically, an identity thief steals your employment information and Social Security number – and files a fraudulent tax return on your behalf. Then, they steal your refund and can even put you in a hole owing back taxes you might not actually owe.

Unfortunately once the IRS sends your tax refund out, it’s nearly impossible to get the money back without knowing the law and regulations. One way to avoid falling victim to tax fraud is to file your taxes as early as possible. This reduces the chances of tax identity theft by filing before the identity thief gets a chance to file a fraudulent return.

CORRECT MISTAKES SOONER

Filing your tax return earlier makes it easier to fix any mistakes on your tax documents. For example, your employer might record the wrong earnings on your W-2. If you wait too long to file, you may not have time to fix these mistakes. Your tax return will end up getting delayed and you will have to go through the process of requesting an extension from the IRS, tacking on penalties and interests, that are compounded daily, to your tax liability.

YOU MIGHT OWE THE IRS MONEY

Unfortunately, many taxpayers end up owing the government money because they underestimate their tax liability during the year. The IRS charges taxpayers a penalty for underpaying their taxes as well as interest on the amount of taxes that they owe.

Therefore, the sooner you file and pay any remaining taxes, the smaller your financial penalty and interest will be. If you can’t pay up front, you might have tax relief options.

IMPORTANT: We highly recommend readers to reach out to our firm before filing. Our clients never have to talk to the IRS, and tax resolution through our firm can save you money and time in the long run. You might also be eligible for other relief programs or get your penalties and interest forgiven. Reach out to our firm today for a consultation. www.mytaxcoaching.com/relief

GET IT OVER WITH

There’s no better tax relief than just finally taking care of your taxes. Many taxpayers feel stress over taxes, but getting them done will actually make you feel better. So don’t procrastinate filing your tax return.

Just get it over with so it’s not hanging over your head! The peace of mind you get from knowing where you stand with the IRS is worth it. It’s often not as bad as you think, even if you owe back taxes. Using a firm like ours to represent you can be worth it in the long run.

Our firm specializes in tax resolution. We serve clients virtually as well as in person so don’t hesitate to reach out. If you want an expert tax resolution specialist who knows how to navigate the IRS maze, reach out to our firm and we’ll schedule a no-obligation confidential consultation to explain your options to permanently resolve your tax problem. www.mytaxcoaching.com/relief